Table of Content

Providers will attempt to make them look low cost, however you end up paying a lot in charges over a reasonably brief time frame. That’s why we virtually all the time advocate going with one of the best small-business loans as an alternative. So you think you want a merchant money advance ―or a lump sum of up-front money, which you repay with a percentage of your every day credit and debit card sales. A service provider cash advance can be a tool to entry capital quickly, but it can additionally put a enterprise in cash flow jeopardy if you’re not careful. Not technically a service provider cash advance, American Express Merchant Financing is a short-term loan for businesses that settle for American Express bank card payments.

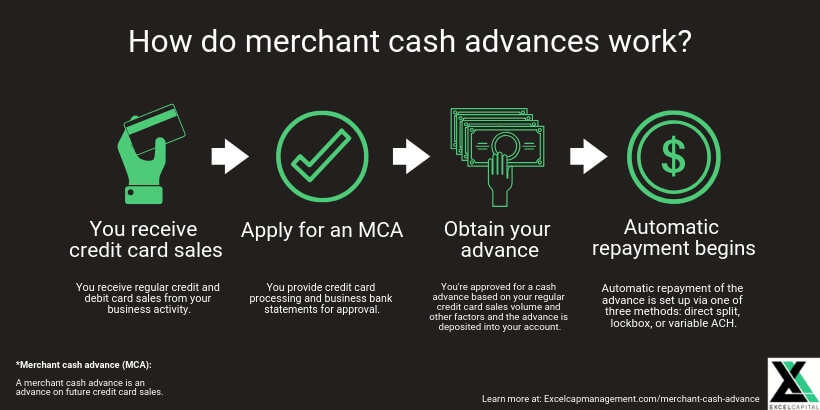

Getting a merchant money advance is fast and simple, and submitting an application can take very little time. In truth, you might be able to get approval the same day you apply and receive your funding a day or two after that. In the past, most merchant money advances had been repaid by way of split payment processing. The merchant money advance would staff up together with your funds processor . The payments processor would reserve a share of every sale on your advance supplier earlier than sending you the rest.

What Is An Mca Lender Buying?

Think of it as more of a calculation somewhat than an rate of interest share. Ramp presents a free corporate card and finance administration system for small companies. If the withdrawals arefixed,the provider will merely deduct the same amount of money each fee interval. For instance, when you make about $1,000 a day, the provider will deduct $150 day by day.

Please note that the compensation starts instantly after the funds hit your small business bank account. If you’re moving into the murky waters of merchant cash advances for the primary time, you might be beneath the frequent false impression that an MCA is a loan. While service provider money advances are a type of exterior financing for small businesses, they're technically not a loan. GoKapital presents enterprise owners different working capital solutions through our various funding applications for business loans. Opposed to fixed payments loans, in a cash advance the agreed quantity is routinely deducted from the every day sales generated on your service provider account till the advance is paid off. A merchant money advance provides hassle-free, low-cost financing that can assist you to recover from monetary obstacles.

Time In Business4 Months+

Such an approach offers a security internet for those who can’t meet the monetary requirement because of the off-season. The fact of the matter is that the service provider cash advance business is growing at a rapid tempo. This is due to the truth that they're ready to assist businesses meet a few of their needs. At the identical time, this business has also faced a lot of criticism. We have a look at the varied execs and cons related to the merchant money advance product within the next article. Over the years, several industrial banks have innovated and created a lending product that's completely based mostly on the point of sales system.

But the reality is,unfavorable credit score ratings doesn't mean your corporation is failing. Many small enterprise house owners have bother as a end result of they'd no selection but touse private credit cards to keep their business alivewhen they hit an early pace bump. We work with small enterprise house owners to safe service provider cash advances from mca suppliers. It’s essential to mention that service provider cash advances usually are not cheaper than other small enterprise loans.

Merchant cash advances generally have higher charges and costs than different lending merchandise, and might usually appeal to predatory lenders. They’re normally recommended as a final resort in relation to funding choices. For instance, in case you have ever considered working with buyers, a mortgage will permit you to stay in charge of your company. Let’s take a closer take a look at a few of the reasons why you ought to not finance with a service provider cash advance and why it’s recommended to search for better financial alternate options to help your business. During your utility, the supplier will assign you a loan officer to guide you through the whole process.

The lender will present financing to the enterprise or merchant, and then remit a percentage of the company’s every day bank card transactions. Yes, this product is available tosmall business homeowners with bad credit. Remember, your borrowing quantity relies almost totally on your daily or weekly debit and credit card gross sales. And since the compensation construction of a merchant money advance is expensive by nature, borrowers are mainly expected to have dangerous fico scores. However, your fico scores will impact the product’s price and terms.

Larger cost amounts offset the heightened degree of danger placed upon the service provider money advance company. If you’re a small business proprietor who needs quick access to capital right away, a Merchant Cash Advance could presumably be what you’re on the lookout for. Also referred to as a Business Cash Advance, this type of money advance a service provider can take is well accessible and comes with versatile payment phrases. Typical requirements like a wonderful credit score rating or overflowing monetary statements aren’t mandatory for merchant cash advance eligibility.

The finest way to get from Gunzenhausen to Nuremberg and not using a automotive is to train by way of Ansbach which takes 1h and prices €12 - €35. The quickest approach to get from Gunzenhausen to Nuremberg is to taxi which costs €110 - €140 and takes 46 min. The greatest method to get from Gunzenhausen to Achenkirch without a automobile is to coach and line 9550 bus through Augsburg which takes 5h 39m and prices . The quickest way to get from Gunzenhausen to Achenkirch is to drive which prices €40 - €65 and takes 2h 42m. Financial Pupil is run by Jeff, a Harvard 2025 economics scholar who has worked in personal equity and is passionate about serving to different younger adults learn about private finance.

Stripe Capital: Greatest For Stripe Users

Our group of pros at Leo Capital Group will work exhausting to complete the approval course of inside in the future to meet your wants instantly. While MCAs may appear to be a saving grace for hundreds of thousands of small business owners, in addition they include their share of pitfalls and could put your small business in further debt. Keep reading to study extra about Merchant Cash Advances, how they work, and the potential dangers of utilizing an MCA for your small business. We believe that each entrepreneur deserves the chance to excel.

It is taken into account an various to a standard small business loan. While MCAs have some perks that may make them attractive to companies, they can even have plenty of drawbacks that small enterprise house owners want to be aware of. Qualifying for a merchant money advance is pretty easy. These days, it is normal for MCA suppliers to supply an easy online software with a faster turnaround time. So, the applying only takes a few minutes, and you'll obtain an approval letter within 2-3 business days.

The lender would then take a proportion of your day by day card gross sales till your balance, plus curiosity and costs are paid in full. In addition, the amount you obtain as a cash advance performs a considerable function in figuring out your cash advance repayment period, which can be anyplace between ninety days and 18 months. Although, if your corporation is doing nice and receiving enough bank card transactions, you might be in a position to pay off the cash advance before expected. While most money advance lenders don’t offer any kind of saving for fully-repaying the mortgage earlier than the term is up, there are some funders who do offer early fee financial savings.

You may think that service provider money advance firms are loaning you cash that you repay together with your future credit card sales, however that’s not technically correct. Because an MCA isn't a loan and is basically an advance based mostly upon your bank card quantity, the method in which you repay the advance and the charges you pay would possibly really feel unfamiliar with what you might be accustomed to. Most MCA suppliers debit cash from your every day credit card transactions to repay the MCA .

No comments:

Post a Comment